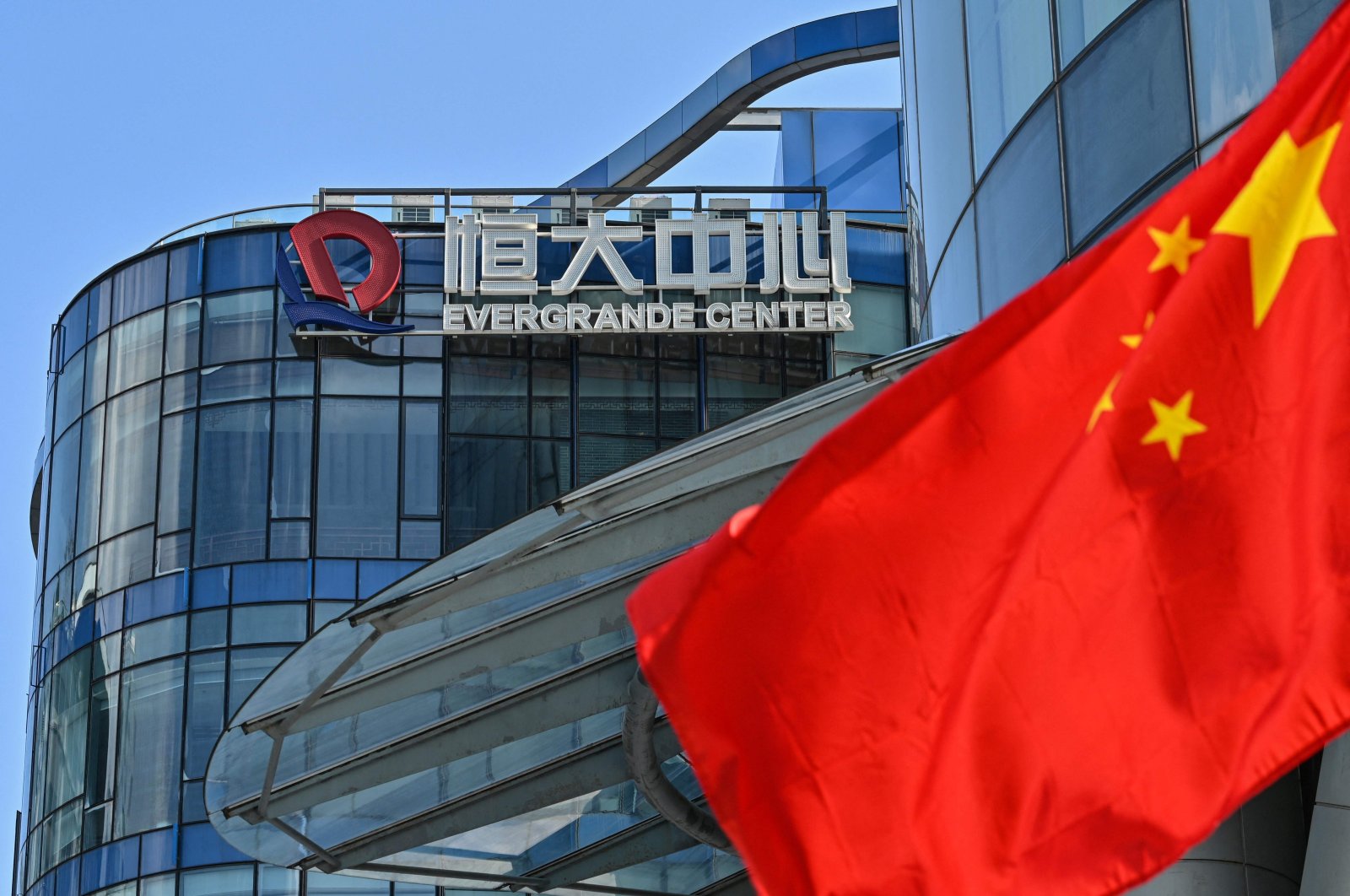

Shares of the embattled Chinese property developer Evergrande Group have once again been suspended from trading, the company announced Monday, pending the release of “inside information.”

Evergrande, the world’s most indebted developer, is struggling to repay more than $300 billion in liabilities, including nearly $20 billion of international market bonds that were deemed to be in cross-default by rating firms last month after it missed payments.

The property developer missed new coupon payments worth $255 million due last Tuesday, though both have a 30-day grace period.

Chinese property firms have struggled in the wake of Beijing’s drive to curb excessive debt in the real estate sector as well as rampant consumer speculation.

“At the request of the company, trading in the shares of the company was halted at 9 a.m. on Jan. 3, 2022, pending the release by the company of an announcement containing inside information,” the group said in a short statement on the Hong Kong stock exchange.

It previously saw a period of suspended share trading back in October.

The troubled developer has set up a risk management committee with many members from state companies and said it would actively engage with its creditors.

Local media reported that a city government in the Chinese resort island of Hainan had ordered Evergrande on Dec. 30 to demolish its 39 residential buildings within 10 days, due to illegal construction.

The buildings stretched over 435,000 square meters, the reports added, citing an official notice to Evergrande’s unit in Hainan.

On Friday, Evergrande dialed back plans to repay investors in its wealth management products, saying each investor in its wealth management product could expect to receive 8,000 yuan ($1,257) per month as principal payment for three months irrespective of when the investment matures.

The move highlights the deepening liquidity squeeze at the property developer.

The provincial government of Guangdong – where the firm is headquartered – is currently overseeing Evergrande’s debt restructuring process.

“The market is watching the asset disposal progress from Evergrande to repay its debt, but the process will take time,” said Conita Hung, investment strategy director at Tiger Faith Asset Management.

“And the demolition order in Hainan will hurt the little homebuyer confidence remained in the company.”

Evergrande said last week 91.7% of its national projects have resumed construction after three months of effort. Many projects were halted previously after the developer failed to pay its many suppliers and contractors.

Shares of Evergrande shed 89% last year, closing at HK$1.59 on Friday.

Its electric vehicle (EV) unit, China Evergrande New Energy Vehicle Group, reversed early losses to rise 14% in early afternoon trade on Monday while property management unit Evergrande Services also turned around from the red to rise 1%.

Evergrande's woes have had knock-on effects throughout China’s property sector with some smaller firms also defaulting on loans and others struggling to find enough cash.

Bloomberg News calculates that China’s property firms need to stump up some $197 billion to cover maturing bonds, coupons, trust products and deferred wages to millions of migrant workers in January.

Evergrande shares halted pending release of 'inside information' | Daily Sabah - Daily Sabah

Read More

No comments:

Post a Comment