Micro, Small and Medium Enterprises (MSMEs) have been hit the hardest by Covid-19 and lockdowns that were announced to control the spread of the coronavirus.

Data from Bengaluru-based nonprofit mass entrepreneurship facilitator Global Alliance for Mass Entrepreneurship (GAME), American commercial data analytics company Dun & Bradstreet, and the India arm of the philanthropic investment company Omidyar Network show that the MSME sector is badly hit due to delayed payments.

The worst sufferers are the smaller ones among the MSMEs, which is set to delay their post pandemic recovery.

What are the main findings of the report?

Subscriber Only Stories

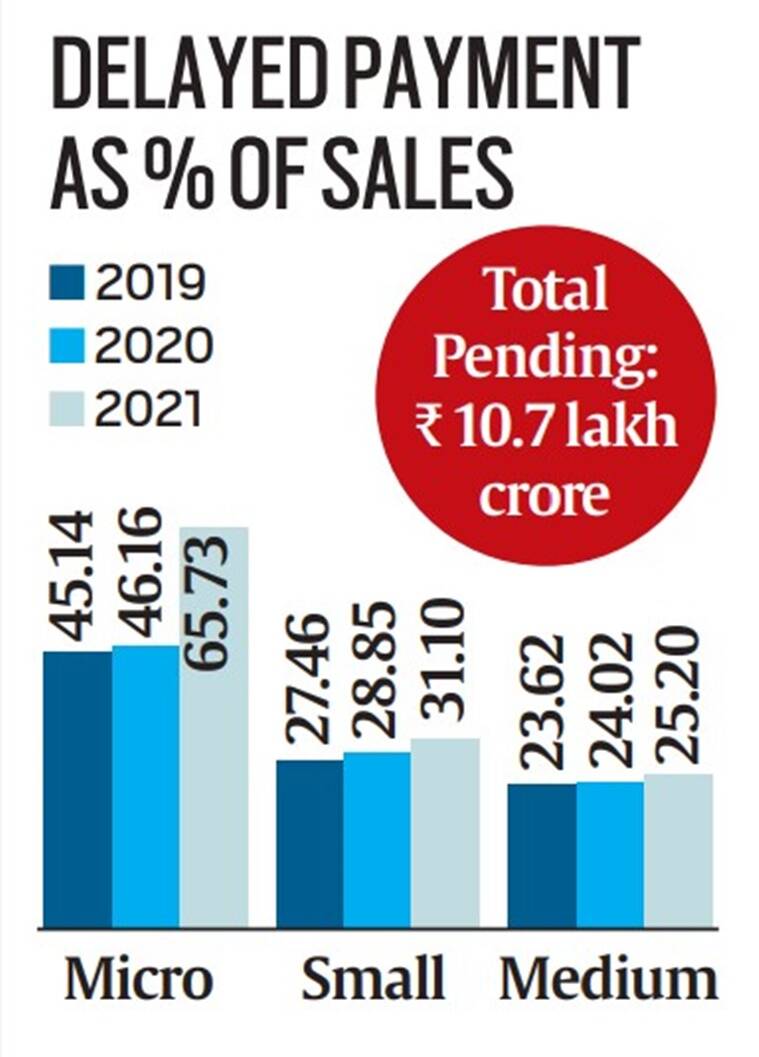

Delayed payments from both private and government buyers is impacting the return of the MSME sector post the pandemic. Among the MSMEs, the worst impacted are those with the smallest establishments — the micro and small units — whose pending dues have now touched Rs 8.73 lakh crore, almost 80% of the total pending for the entire MSME sector until 2021.

Delayed payments as percentage of sales has seen a sharp spike from 46.16 per cent in 2020 to 65.73 per cent in 2021 for the ‘micro’ segment, and from 28.85 per cent to 31.10 per cent for ‘small’ units, says the report.

However, the rise in delayed payments as a percentage of sales has been much lower for ‘medium’ segment units, up from 24.02 per cent in 2020 to 25.20 per cent in 2021.

A year-wise break-up of delayed payments as percentage of sales.

A year-wise break-up of delayed payments as percentage of sales.

How are the units under MSME categorised?

Micro units are those with investments up to Rs 1 crore and turnover of less than Rs 5 crore. For small units, the investment limit is Rs 10 crore, and turnover is pegged at less than Rs 50 crore. A unit is termed medium if it has investments of up to Rs 20 crore with a turnover of less than Rs 100 crore.

How is the government dealing with this problem?

Nitin Gadkari, then Minister for MSME, had flagged way back in mid-2020 that state and Central governments, their ministries and PSUs, and major industries combined owed an estimated Rs 5 lakh crore to MSMEs.

The government, in 2020, had asked both PSUs and the top 500 companies to clear their dues to units in the sector. This was done as part of the government’s plan to ensure enough liquidity for MSME units along with a credit facility for the sector under the Emergency Credit Line Guarantee Scheme (ECLGS) scheme.

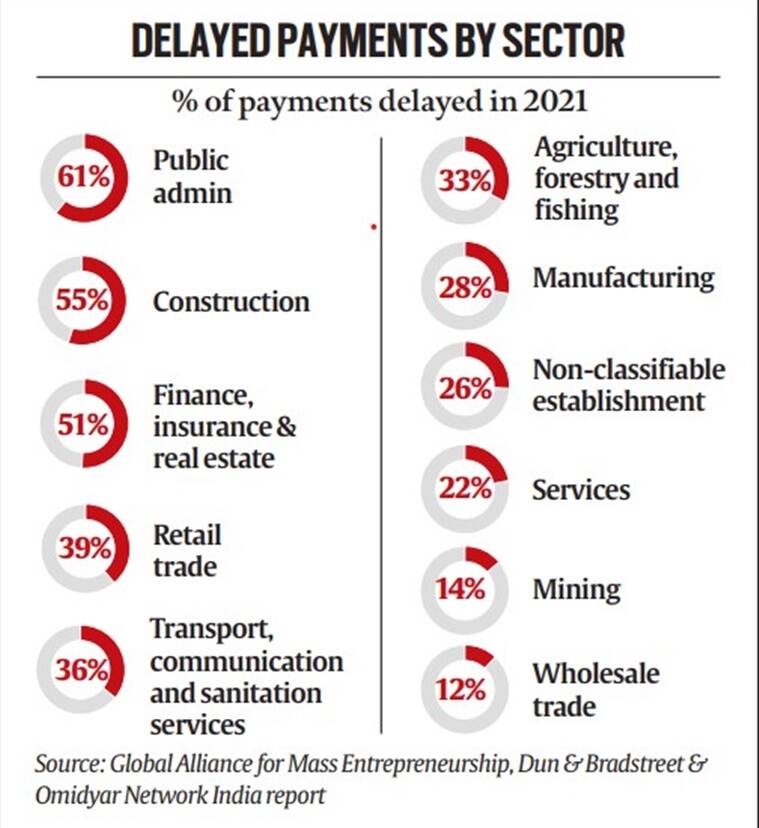

A sector-wise break-up of delay in payments.

A sector-wise break-up of delay in payments.

Have the government diktats worked?

Despite various diktats from the Centre, the value of delayed payments to the MSME sector has increased to Rs 10.7 lakh crore until the end of calendar year 2021, according to the report.

About 81 per cent of the total amount is owed to small and micro enterprises: Rs 4.29 lakh crore to small enterprises and Rs 4.44 lakh crore to micro enterprises. Highlighting the severity of the problem, the report says that median debtor days beyond the legally recommended 45-day period for micro enterprises in 2020-21 was 6.5 months (195 days), compared to two months (68 days) for small enterprises, and 1.5 months (47 days) for medium enterprises.

Explained: How the 'long Covid' of pending payments has brought India's MSME sector to its knees - The Indian Express

Read More

No comments:

Post a Comment